Unlocking Your Dream Ride: A Comprehensive Guide to "Trucks For Sale Near Me Buy Here Pay Here"

Unlocking Your Dream Ride: A Comprehensive Guide to "Trucks For Sale Near Me Buy Here Pay Here" Typestruck.Guidemechanic.com

Finding the perfect truck can be a journey, especially when traditional financing options feel like an uphill battle. Perhaps your credit score has taken a hit, or you’re just starting out and haven’t built a credit history yet. Whatever your situation, the desire for a reliable truck—whether for work, family, or adventure—remains strong. This is where "Buy Here Pay Here" (BHPH) dealerships enter the picture, offering a unique pathway to truck ownership.

As an expert blogger and SEO content writer with years of experience navigating the automotive industry, I understand the complexities and the crucial need for clear, honest information. This in-depth guide is designed to be your ultimate resource, demystifying the world of "Trucks For Sale Near Me Buy Here Pay Here." We’ll explore everything from understanding the model itself to smart buying strategies, ensuring you make an informed decision and drive away with confidence.

Unlocking Your Dream Ride: A Comprehensive Guide to "Trucks For Sale Near Me Buy Here Pay Here"

What Exactly Does "Buy Here Pay Here" Mean?

The "Buy Here Pay Here" model is a specific type of dealership where the dealer acts as both the seller of the vehicle and the lender of the financing. Unlike traditional dealerships that work with external banks or credit unions, a BHPH dealership handles the entire transaction in-house. This direct approach simplifies the approval process, making it accessible to a wider range of buyers.

Essentially, when you see "Trucks For Sale Near Me Buy Here Pay Here," it means you’re looking at dealerships that provide their own financing. This can be a game-changer for individuals who might be turned down by conventional lenders due to poor credit, no credit, or even past bankruptcies. The dealership takes on the credit risk directly, often focusing more on your income and ability to make payments than your credit history alone.

Why Consider BHPH for Trucks, Specifically?

Trucks are significant investments, often more expensive than sedans or compact cars, and their utility makes them essential for many people. For those needing a truck but facing financing challenges, the BHPH model offers a practical solution. It bridges the gap between the demand for a heavy-duty vehicle and the reality of a less-than-perfect credit score.

The unique financial structure of BHPH dealerships means they are often more flexible in their approval criteria. They understand that life happens, and a credit score doesn’t always tell the full story of someone’s financial responsibility. This flexibility is particularly valuable when you need a robust vehicle like a truck for your livelihood or daily demands.

The Clear Advantages of Choosing a BHPH Dealership for Your Truck

Opting for a "Buy Here Pay Here" dealership to find your next truck comes with several distinct benefits, especially if traditional financing routes are closed off. Understanding these advantages can help you determine if this path is right for you.

1. Easier Approval Process

One of the most significant benefits of BHPH dealerships is their relaxed approval criteria. Traditional lenders heavily rely on credit scores, debt-to-income ratios, and extensive financial histories. BHPH dealers, however, often prioritize your current income and ability to make regular payments.

Based on my experience, many buyers who have been rejected by banks find a welcoming door at BHPH lots. This simplified process means you can often get approved and drive away with a truck much faster, sometimes even on the same day. It removes the stress and uncertainty associated with endless loan applications and credit checks.

2. Opportunity to Rebuild Credit

While not all BHPH dealerships report to major credit bureaus, many now do. This means that consistent, on-time payments on your truck loan can positively impact your credit score. It’s a fantastic way to demonstrate financial responsibility and slowly improve your credit profile.

Pro tips from us: Always inquire if the dealership reports payments to credit bureaus before signing any contract. This small detail can turn your truck purchase into a valuable credit-building tool, opening up more financial opportunities down the road.

3. Convenience and Speed

The all-in-one nature of BHPH dealerships means less paperwork, fewer waiting periods, and a more streamlined purchasing experience. You deal directly with one entity for both the sale and the financing, which can save a lot of time and hassle.

For individuals with busy schedules who need a truck quickly, this convenience is invaluable. You can often complete the entire buying process, from selection to driving off the lot, in a single visit.

4. Personalized Payment Plans

Since the dealership is also the lender, they often have more leeway to structure payment plans that align with your income schedule. If you get paid bi-weekly or monthly, they can often set up your truck payments to match. This personalized approach can make managing your finances easier and reduce the risk of missed payments.

Common mistakes to avoid are not discussing your payment frequency preferences upfront. Being clear about your financial rhythm can help the dealer craft a plan that works best for you.

Potential Drawbacks to Be Aware Of

While BHPH offers a lifeline for many, it’s crucial to approach it with a clear understanding of its potential downsides. Being informed about these challenges allows you to mitigate risks and make a more prudent decision.

1. Higher Interest Rates

Due to the increased risk BHPH dealerships take on by financing buyers with challenging credit, their interest rates are typically higher than those offered by traditional lenders. This higher APR (Annual Percentage Rate) means you’ll pay more for the truck over the life of the loan.

It’s essential to factor this into your budget and understand the total cost of the truck. While the monthly payment might seem manageable, the cumulative interest can add up significantly.

2. Limited Vehicle Selection

BHPH dealerships often specialize in older, higher-mileage used vehicles. While you might find a robust truck, the selection may not be as extensive or as new as what you’d find at a conventional dealership. You might have fewer choices in terms of make, model, year, and features.

This limited inventory means you might need to be more flexible with your preferences. The focus tends to be on reliability and affordability rather than cutting-edge technology or luxury features.

3. Shorter Loan Terms and More Frequent Payments

To mitigate their risk and ensure quicker repayment, BHPH loans often come with shorter loan terms. This can lead to higher monthly or even bi-weekly payments, which can strain your budget if not carefully planned. Some dealerships might also require more frequent payments, such as weekly or bi-weekly, aligning with common pay cycles.

Based on my experience, it’s vital to ensure these payment frequencies and amounts fit comfortably within your regular income. Overextending yourself can lead to payment difficulties and potential repossession.

4. Potential for Predatory Practices

Unfortunately, like any financial sector, some less reputable BHPH dealerships exist. These may engage in practices like charging excessive fees, rolling over negative equity from previous loans, or using aggressive collection tactics. It’s important to be vigilant and conduct thorough research.

Pro tips from us: Always read reviews, check with the Better Business Bureau, and look for dealers known for transparency and fair dealing. Your due diligence is your best defense against unscrupulous practices.

Finding Reputable "Trucks For Sale Near Me Buy Here Pay Here" Dealerships

Locating a trustworthy BHPH dealer is paramount to a successful purchase. Not all dealerships are created equal, and some go above and beyond to serve their customers fairly.

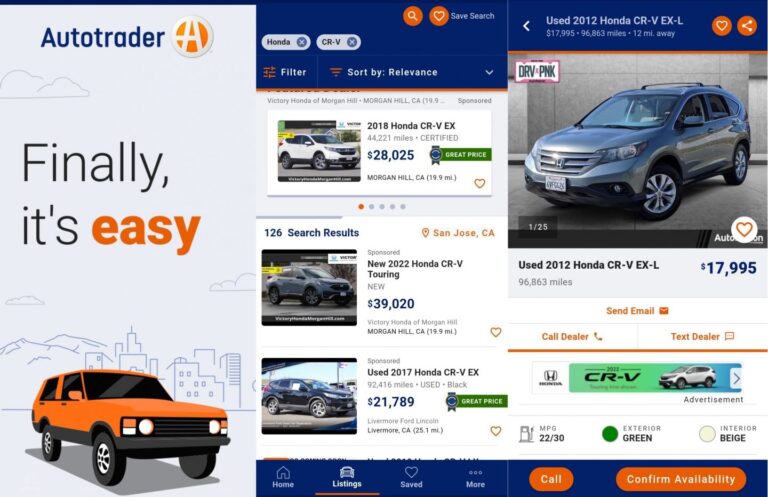

1. Online Search and Reviews

Start with a simple Google search for "Trucks For Sale Near Me Buy Here Pay Here" or "BHPH trucks ". Pay close attention to online reviews on platforms like Google, Yelp, and the Better Business Bureau. Look for consistent positive feedback regarding customer service, vehicle quality, and transparency.

A high volume of positive reviews, especially those mentioning fair pricing and helpful staff, is a good indicator. Conversely, a pattern of complaints about hidden fees, vehicle breakdowns, or aggressive sales tactics should be a red flag.

2. Ask for Recommendations

Word-of-mouth is a powerful tool. Ask friends, family, or colleagues who have experience with BHPH dealerships for their recommendations. Personal endorsements often lead to the most reliable sources.

Someone who has successfully purchased a truck through a BHPH dealer and had a positive experience can provide invaluable insights and steer you toward a reputable establishment.

3. Dealership Longevity and Professionalism

Consider dealerships that have been in business for a significant period. Longevity often suggests a stable and trustworthy operation. When you visit, observe the professionalism of the staff and the condition of the lot and vehicles. A well-maintained dealership usually reflects a commitment to quality.

The BHPH Truck Buying Process: A Step-by-Step Guide

Navigating the purchase of a BHPH truck involves a few distinct steps. Understanding this process can help you feel more prepared and in control.

Step 1: Gather Your Documentation

Before you even visit a dealership, compile necessary documents. This typically includes proof of income (pay stubs, bank statements), proof of residency (utility bill, lease agreement), a valid driver’s license, and references. The more prepared you are, the smoother the application process will be.

Having these documents ready demonstrates your seriousness and can expedite your approval.

Step 2: Set a Realistic Budget

Determine how much you can truly afford for a truck payment on a weekly or bi-weekly basis. Remember to account for potential higher interest rates and other costs like insurance, fuel, and maintenance. Don’t just focus on the sticker price; consider the total cost of ownership.

Pro tips from us: Use an online budget calculator to get a clear picture of your disposable income after essential expenses. This prevents overcommitment and financial strain.

Step 3: Vehicle Selection and Inspection

Once approved for financing, you’ll select a truck from the dealership’s inventory. Take your time to thoroughly inspect any vehicle you’re considering. This is arguably the most critical step in buying a used truck, especially from a BHPH lot where vehicles might be older.

We’ll delve deeper into what to look for in a used truck shortly, but remember that a comprehensive inspection is non-negotiable.

Step 4: Understand the Terms and Sign the Contract

This is where many common mistakes are made. Read the entire contract carefully before signing. Pay close attention to the purchase price, interest rate (APR), total amount financed, total payments, any fees, and the repayment schedule. Do not hesitate to ask questions about anything you don’t understand.

If possible, have a trusted friend or family member review the contract with you. This second set of eyes can catch details you might miss.

Step 5: Drive Away and Make Payments On Time

Once the paperwork is complete, you can drive away in your new-to-you truck! The final and ongoing step is to make all your payments on time, every time. This is crucial for avoiding late fees, potential repossession, and, if the dealer reports, for building positive credit history.

What to Look For in a Used Truck from a BHPH Dealership

Given that BHPH inventory often consists of older models, a rigorous inspection process is essential. You want a truck that’s reliable, not one that will become a money pit.

1. Thorough Mechanical Inspection

Never skip this step. If the dealership allows, bring a trusted mechanic to inspect the truck. If not, take it to an independent shop for a pre-purchase inspection (PPI). This small investment can save you thousands down the road by uncovering hidden issues.

Based on my experience, a PPI is the single best preventative measure you can take when buying a used vehicle. It gives you an unbiased assessment of the truck’s true condition.

2. Check the Vehicle History Report (e.g., CarFax, AutoCheck)

Request a vehicle history report. This report can reveal crucial information like past accidents, flood damage, salvage titles, odometer discrepancies, and service history. A clean title is important, and understanding any past incidents can help you assess the truck’s long-term reliability.

Common mistakes to avoid are trusting a verbal assurance; always ask for the physical report or a link to it.

3. Test Drive Extensively

Don’t just drive around the block. Take the truck on various roads – city streets, highways, and even some bumps if possible. Listen for unusual noises, feel for vibrations, test the brakes thoroughly, and check that all electrical components (lights, AC, radio, windows) are working.

Pay attention to how the transmission shifts, how the engine sounds under acceleration, and if the steering feels tight and responsive.

4. Inspect for Rust and Body Damage

Trucks often lead tougher lives than cars, so check thoroughly for rust, especially on the frame, undercarriage, and around wheel wells. Significant rust can indicate structural integrity issues. Also, look for signs of previous bodywork or repainting that might suggest a major accident.

Understanding Your BHPH Contract: Key Elements

The financing contract is the backbone of your BHPH truck purchase. A clear understanding of its components is vital.

1. The Purchase Price and Down Payment

This is the agreed-upon price of the truck. BHPH dealers almost always require a down payment, which helps reduce their risk and your total financed amount. Be clear on the exact amount you’re paying and what portion is going towards the principal.

2. Annual Percentage Rate (APR)

This is the interest rate you’ll pay on the loan, expressed as an annual percentage. As mentioned, BHPH APRs are typically higher. Ensure you know the exact percentage and understand how it impacts your total cost.

3. Total Amount Financed vs. Total Payments

The "total amount financed" is the purchase price minus your down payment, plus any additional fees or charges. The "total payments" figure is the sum of all your scheduled payments over the life of the loan. This number will always be higher than the total amount financed due to interest.

4. Payment Schedule and Frequency

Confirm whether payments are weekly, bi-weekly, or monthly. Know the exact due dates and the amount of each payment. Consistency in payment frequency is a hallmark of BHPH agreements.

5. Late Fees and Repossession Clause

Every contract will outline penalties for late payments and the conditions under which the dealership can repossess the vehicle. Understand these terms fully. Pro tips from us: Ask for clarification on grace periods and what actions trigger repossession.

Common Mistakes to Avoid When Buying a BHPH Truck

Based on my experience, buyers often fall into certain traps. Being aware of these can save you headaches and money.

- Not setting a realistic budget: Overestimating what you can afford leads to financial strain and potential repossession.

- Skipping the vehicle inspection: Assuming the truck is mechanically sound without an independent check is a huge gamble.

- Not reading the contract thoroughly: Signing without understanding all terms can lead to unexpected costs or unfavorable conditions.

- Focusing only on monthly payments: Neglecting the total cost of the loan due to high interest rates.

- Ignoring dealership reputation: Choosing a dealer solely based on vehicle availability without checking reviews and credibility.

- Not clarifying credit reporting: Assuming payments will build credit without confirming if the dealer reports to bureaus.

Pro Tips for a Successful BHPH Truck Purchase

To ensure you get the best possible deal and experience, keep these expert tips in mind:

- Save a Larger Down Payment: The more you can put down upfront, the less you’ll finance, reducing your total interest paid and potentially lowering your monthly payments.

- Negotiate (Within Reason): While BHPH pricing might be less flexible than traditional dealerships, there might still be room to negotiate the down payment, interest rate (if your situation allows), or even the overall price of the truck. It never hurts to ask respectfully.

- Budget for Insurance and Maintenance: Factor in the cost of truck insurance, which can be higher for older vehicles, and set aside funds for unexpected repairs. Used trucks, by nature, require more attention.

- Consider a Co-Signer (If Applicable): If you have a trusted individual with better credit willing to co-sign, it could potentially help you secure a lower interest rate or better terms. However, ensure they understand the full responsibility involved.

- Communicate with Your Dealer: If you ever anticipate difficulty making a payment, contact your dealer immediately. Open communication can sometimes lead to temporary arrangements and prevent repossession.

- Keep Excellent Records: Maintain copies of all your paperwork, payment receipts, and any communication with the dealership. This provides a clear paper trail if any disputes arise.

Building Credit with Your BHPH Truck Loan

One of the often-overlooked advantages of a "Buy Here Pay Here" loan is its potential to serve as a credit-building tool. However, this only works if certain conditions are met.

First and foremost, you must confirm that the BHPH dealership reports your payment history to one or more of the major credit bureaus (Experian, Equifax, TransUnion). Not all dealers do this, and if they don’t, your timely payments won’t reflect on your credit report. This is a critical question to ask before signing any contract.

If they do report, making consistent, on-time payments is paramount. Every on-time payment demonstrates financial responsibility, slowly but surely improving your credit score. This can open doors to better interest rates for future loans, credit cards, and even housing opportunities. Conversely, late or missed payments will negatively impact your score, so commitment is key.

Alternatives to BHPH (Briefly)

While BHPH is a viable option, it’s worth briefly considering other avenues if your credit situation is improving or less severe:

- Credit Unions: Often offer more favorable rates and terms than traditional banks, especially for members.

- Subprime Auto Lenders: These are traditional lenders specializing in loans for individuals with less-than-perfect credit but often have better rates than BHPH.

- Private Sellers with Personal Loans: If you can secure a personal loan from a bank or credit union, buying directly from a private seller might offer a lower purchase price.

Your Journey to a Truck Starts Here

Finding "Trucks For Sale Near Me Buy Here Pay Here" can be an excellent solution for many individuals who need a reliable vehicle but face credit challenges. It offers a pathway to ownership, convenience, and a chance to rebuild your financial standing. However, like any significant purchase, it demands thorough research, careful consideration, and a proactive approach.

By understanding the pros and cons, meticulously inspecting your chosen truck, and diligently reviewing your contract, you empower yourself to make a smart decision. Based on my experience, an informed buyer is a successful buyer. Use this guide as your compass, do your homework, and you’ll be well on your way to driving off in a truck that meets your needs and helps you move forward.

- Want to learn more about maintaining your new-to-you truck? Check out our guide on .

- Curious about other financing options? Read our article on .

- For more general advice on responsible credit management, visit a trusted financial literacy resource like the Consumer Financial Protection Bureau (CFPB) at .