Unlocking the Open Road: Your Comprehensive Guide to Used Semi Trucks For Sale with Bad Credit

Unlocking the Open Road: Your Comprehensive Guide to Used Semi Trucks For Sale with Bad Credit Typestruck.Guidemechanic.com

The dream of owning your own semi-truck and hitting the open road as an independent owner-operator is a powerful one. It represents freedom, financial independence, and the opportunity to build a legacy. However, for many aspiring truckers, a less-than-perfect credit score can feel like an insurmountable roadblock, halting those dreams before they even leave the depot.

If you’ve been searching for "used semi trucks for sale bad credit" and feeling overwhelmed by the challenges, you’ve come to the right place. This in-depth guide is designed to cut through the confusion, offering practical strategies and expert insights to help you navigate the complex world of commercial truck financing, even when your credit history isn’t pristine. We believe that a challenging credit past doesn’t have to define your future in trucking.

Unlocking the Open Road: Your Comprehensive Guide to Used Semi Trucks For Sale with Bad Credit

The Owner-Operator Dream Meets the Credit Reality

Owning a semi-truck isn’t just about driving; it’s about running a business. As an owner-operator, you gain control over your routes, your schedule, and your income potential. This level of autonomy is incredibly appealing, drawing countless individuals to the profession.

However, the significant upfront investment required for a semi-truck often necessitates financing. This is where a low credit score can create a substantial hurdle. Traditional lenders, primarily banks, are inherently risk-averse and typically prefer borrowers with strong credit histories and established financial stability.

Understanding "Bad Credit" in Commercial Truck Financing

Before we delve into solutions, it’s crucial to understand what "bad credit" means in the context of securing a loan for a used semi-truck. Generally, a FICO score below 620-640 is often considered subprime by conventional lenders. This can be due to a variety of factors:

- Late payments: A history of missed or delayed payments on credit cards, mortgages, or other loans.

- Defaults or collections: Unpaid debts that have been sent to collection agencies.

- Bankruptcies or foreclosures: Major financial distress events that significantly impact credit.

- High credit utilization: Using a large percentage of your available credit.

- Limited credit history: Not having enough credit accounts to generate a robust score.

When lenders assess your application for a used semi truck loan, they are primarily evaluating risk. A lower credit score signals a higher perceived risk of default. This doesn’t mean you’re unapproachable, but it does mean you’ll need to approach the financing process strategically.

Dispelling Myths: Yes, Used Semi Truck Financing with Bad Credit IS Possible

One of the biggest misconceptions is that "bad credit" automatically means "no financing." This is simply not true. While the path might be different and potentially more challenging, it is absolutely possible to secure used semi truck financing with bad credit.

The key is to understand that the lending landscape is diverse. Beyond traditional banks, there’s a whole ecosystem of specialized lenders, alternative financing companies, and programs designed to help individuals with varying credit profiles. Your dream of owning a semi-truck doesn’t have to end here.

Strategic Approaches to Securing Used Semi Truck Loans with Bad Credit

Navigating the financing landscape with a less-than-perfect credit score requires a multi-pronged approach. Here are some of the most effective strategies you can employ:

1. Target Specialized Lenders and Subprime Financiers

Traditional banks might be a tough sell, but many lenders specialize in commercial truck financing for individuals with challenging credit. These "subprime" or "alternative" lenders often have more flexible underwriting criteria.

They understand that life happens and that a past financial stumble doesn’t necessarily indicate future irresponsibility. Instead of solely focusing on your credit score, they consider a broader picture, including your trucking experience, down payment, and the specific truck you intend to purchase.

2. Prioritize a Substantial Down Payment

One of the most impactful ways to offset a bad credit score is by offering a larger down payment. From a lender’s perspective, a significant down payment reduces their risk considerably. It shows your commitment to the purchase and provides a larger equity cushion should you default.

Based on my experience in the commercial trucking finance sector, aiming for a down payment of 15-25% or even more can dramatically improve your chances of approval and potentially secure more favorable terms. This might mean saving longer, but it’s an investment that pays off.

3. Explore Lease-to-Own Programs

Lease-to-own or "rent-to-own" options are becoming increasingly popular for owner-operators with bad credit. In this arrangement, you lease the truck with the option to purchase it at the end of the lease term. A portion of your lease payments often goes towards the purchase price.

These programs can be a fantastic entry point into truck ownership, especially if you’re working to rebuild your credit. However, it’s crucial to understand the terms carefully, as some programs can come with higher overall costs or strict conditions. Always scrutinize the fine print.

4. Leverage Collateral or a Co-Signer

If you have other valuable assets, such as real estate or another paid-off vehicle, you might be able to use them as additional collateral to secure your loan. This reduces the lender’s risk and can make your application more appealing.

Alternatively, a co-signer with good credit can significantly boost your application. A co-signer essentially guarantees the loan, promising to make payments if you default. While this can open doors, ensure both you and your co-signer fully understand the responsibilities involved.

5. Focus on Building Business Credit (Long-Term Strategy)

While you’re working on securing your first truck, start thinking about building business credit. This is separate from your personal credit and becomes increasingly important as your trucking business grows.

Opening a business bank account, getting a business EIN, and establishing trade lines with suppliers that report to business credit bureaus are initial steps. A strong business credit profile can unlock better financing opportunities down the road for future truck purchases or expansion. You can find more detailed guidance on this in our article: .

6. Proactively Improve Your Personal Credit Score

Even if you need a truck now, taking steps to improve your personal credit score will always benefit you. This isn’t an overnight fix, but consistent effort yields results.

- Pay bills on time: Set up automatic payments to avoid missing due dates.

- Reduce credit card debt: Aim to keep credit utilization below 30%.

- Review your credit report: Dispute any errors that could be negatively impacting your score.

- Avoid new debt: Don’t open multiple new credit accounts in a short period.

Finding the Right Used Semi Truck: Beyond Just the Price Tag

When you have bad credit, the type and condition of the used semi truck you choose can significantly impact your financing options. Lenders are more comfortable financing newer, well-maintained trucks because they represent less risk of immediate breakdown and depreciation.

1. Prioritize Reliability and Maintenance Records

A cheaper truck upfront might lead to costly repairs down the line, putting a strain on your finances and your ability to make loan payments. Look for trucks with comprehensive service histories and evidence of regular maintenance.

Pro tips from us: Always get an independent inspection by a trusted mechanic before committing to a purchase. This small investment can save you thousands in unexpected repairs. Consider the make and model; some brands are known for their longevity and parts availability.

2. Age and Mileage Matter to Lenders

Generally, lenders prefer trucks that are less than 10 years old and have fewer than 750,000 miles. While it’s possible to finance older trucks, the terms will likely be less favorable, with higher interest rates and shorter repayment periods.

A newer truck with lower mileage offers a longer useful life and greater resale value, making it a more attractive asset for lenders. This can be a balancing act between affordability and financeability.

3. Where to Search for Used Semi Trucks

- Specialized Dealerships: Many dealerships focus solely on commercial trucks and often have relationships with various lenders, including those who work with bad credit.

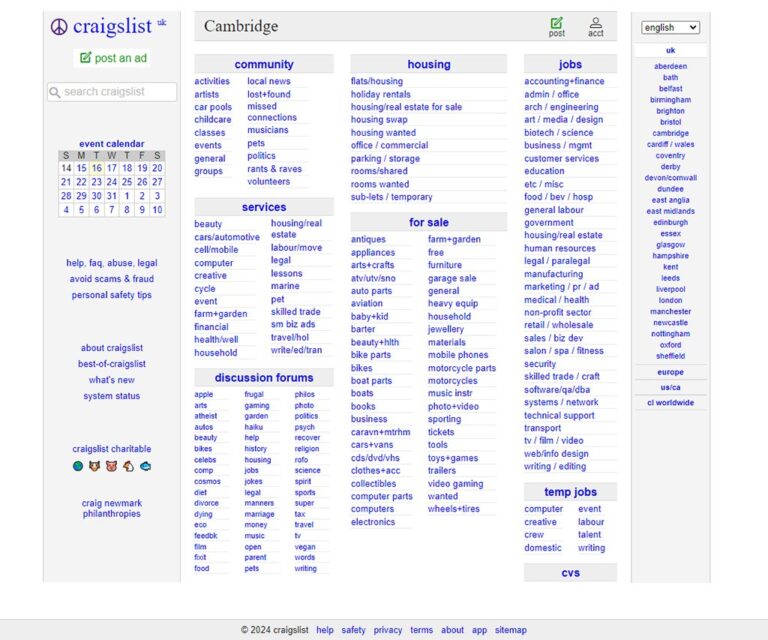

- Online Marketplaces: Websites like TruckPaper.com, CommercialTruckTrader.com, and local classifieds can offer a wide selection. Be cautious and always verify sellers.

- Auctions: While potentially offering lower prices, auctions often require cash payment and don’t allow for thorough inspections, making them riskier for those relying on financing.

The Application Process: Transparency and Preparation Are Key

When applying for used commercial truck loans with bad credit, transparency and thorough preparation are your best allies. Don’t try to hide past financial issues; be upfront and explain any extenuating circumstances.

1. Gather All Necessary Documents

Lenders will want a complete picture of your financial situation and your trucking experience. Be prepared with:

- Personal and business tax returns: Typically for the last 2-3 years.

- Bank statements: Personal and business (if you have one).

- Driver’s license and CDL.

- Proof of residency.

- Trucking experience documentation: Resumes, employment history.

- Business plan (if applicable): Especially if you’re a new owner-operator.

- Vehicle information: Details of the specific truck you intend to buy.

2. Craft a Compelling Business Case

Even with bad credit, if you can demonstrate a solid plan for profitability, lenders will be more inclined to work with you. Highlight your driving experience, your proposed routes, your understanding of operating costs, and how you plan to generate sufficient income to cover your loan payments.

Common mistakes to avoid are submitting an incomplete application or trying to gloss over your credit history. Lenders will uncover everything, so it’s better to address it proactively and demonstrate how you’ve learned from past challenges.

Navigating Loan Terms and Conditions

Securing financing for a semi truck with bad credit often means accepting different loan terms than someone with excellent credit. Understanding these differences is crucial to making an informed decision.

1. Expect Higher Interest Rates

This is perhaps the most significant difference. Lenders charge higher interest rates to compensate for the increased risk associated with bad credit. While this means a higher total cost of the loan, focus on whether the monthly payments are sustainable within your business model.

Pro tips from us: Even with higher rates, look for opportunities to refinance in the future once you’ve made consistent payments and improved your credit score. This can significantly reduce your overall interest burden.

2. Shorter Loan Durations

Loans for used semi trucks with bad credit often come with shorter repayment periods (e.g., 2-4 years instead of 5-7 years). While this means higher monthly payments, it also means you’ll pay less interest over the life of the loan and own the truck outright sooner.

Carefully assess your projected cash flow to ensure you can comfortably meet these higher monthly obligations. A realistic budget is your best friend here.

3. Be Aware of Fees and Clauses

Beyond interest, look out for various fees: origination fees, documentation fees, and late payment penalties. Also, understand clauses like pre-payment penalties (if you pay off the loan early) or balloon payments (a large lump sum due at the end of the loan term).

Based on my experience, some lenders specializing in subprime financing might include GPS tracking or remote shutdown clauses in their contracts. While intrusive, these are sometimes a condition of approval for high-risk borrowers. Understand all implications before signing.

Beyond the Purchase: Making Your Investment Work for You

Buying a used semi-truck with bad credit is just the first step. To truly succeed, you need a robust plan for profitability and financial stability.

1. Master Your Operating Costs

Semi-truck ownership comes with significant ongoing expenses: fuel, insurance, maintenance, tires, tolls, and permits. You must have a clear understanding of these costs and factor them into your rates and budgeting. Neglecting this step is a common pitfall for new owner-operators.

For a comprehensive breakdown of ongoing costs, you might find our guide on helpful in planning your budget.

2. Develop a Solid Business Plan

Even if it’s a simple one, have a plan for how you’ll secure loads, manage your time, and maintain profitability. This includes understanding market rates, building relationships with brokers, and optimizing your routes.

Consistent income is paramount, especially when you have higher loan payments due to your credit situation. Every mile should be carefully considered for its revenue potential.

3. Build a Financial Safety Net

Unexpected breakdowns are a reality in trucking. Having an emergency fund specifically for truck repairs and unexpected downtime is crucial. This buffer prevents you from missing loan payments and spiraling further into financial difficulty.

Pro tips from us: Aim to save at least 3-6 months of operating expenses, including your truck payment, fuel, and insurance. This fund provides peace of mind and resilience in a volatile industry.

4. Rebuild Your Credit with Consistent Payments

Every single on-time payment you make on your semi truck loan is an opportunity to rebuild your credit. As you demonstrate responsible financial behavior, your credit score will gradually improve, opening doors to better financing options in the future.

This journey is not just about owning a truck; it’s about establishing a strong financial foundation for your business and your future.

Steps to Take NOW for Used Semi Trucks For Sale Bad Credit

Don’t let bad credit deter your trucking ambitions. Here’s a clear action plan:

- Assess Your Financial Situation: Get copies of your credit reports from all three major bureaus (Equifax, Experian, TransUnion). Review them for accuracy and understand your current credit score. You can get free annual reports at .

- Determine Your Down Payment: Start saving aggressively. The more you can put down, the better your chances.

- Research Specialized Lenders: Look for lenders who explicitly work with owner-operators and have experience with bad credit semi truck loans. Read reviews and compare terms.

- Get Your Documents in Order: Prepare all the financial and personal documents you’ll need for loan applications.

- Pre-Approval is Your Friend: Seek pre-approval from multiple lenders. This gives you leverage when negotiating for a truck and a clearer picture of what you can afford.

Conclusion: Your Road to Ownership Starts Here

Owning a used semi-truck with bad credit is challenging, but it is absolutely achievable with the right strategy, perseverance, and informed decision-making. By understanding the nuances of commercial truck financing, targeting the right lenders, preparing thoroughly, and making smart choices about the truck itself, you can turn your dream of independent trucking into a reality.

Remember, this journey is about more than just buying a truck; it’s about building a sustainable business and a stronger financial future. Take these steps, stay disciplined, and soon you’ll be driving towards success on the open road. The freedom of being an owner-operator awaits!