The Ultimate Guide to Leasing a Pickup Truck: Unlock Power, Performance, and Value

The Ultimate Guide to Leasing a Pickup Truck: Unlock Power, Performance, and Value Typestruck.Guidemechanic.com

In the dynamic world of vehicles, the pickup truck stands as a symbol of versatility, power, and practicality. Whether you’re a small business owner needing robust hauling capabilities or an adventurer seeking off-road prowess, a pickup truck is often the ideal choice. But when it comes to acquiring one, the decision often boils down to two main paths: buying or leasing. For many, a lease pickup truck offers an attractive, flexible, and often more affordable route to drive the latest models.

This comprehensive guide will delve deep into everything you need to know about leasing a pickup truck. We’ll explore the benefits, decode the jargon, highlight common pitfalls, and equip you with expert strategies to secure the best deal. Our goal is to provide you with a pillar content piece that not only informs but also empowers you to make a smart, confident decision about your next pickup truck.

The Ultimate Guide to Leasing a Pickup Truck: Unlock Power, Performance, and Value

Why Consider Leasing a Pickup Truck? Exploring the Undeniable Advantages

Leasing a pickup truck isn’t just about lower monthly payments; it’s a strategic financial and lifestyle choice for many. It offers a unique set of advantages that outright purchasing often cannot match. Let’s break down the compelling reasons why a pickup truck lease might be the perfect fit for you.

Enjoy Lower Monthly Payments

One of the most immediate and attractive benefits of leasing is the significantly lower monthly outlay compared to financing a purchase. When you lease, you’re essentially paying for the depreciation of the vehicle during the lease term, plus interest and fees, rather than its entire purchase price. This means more money stays in your pocket each month.

Based on my experience, this difference can be substantial, often hundreds of dollars, making premium truck models more accessible. It allows individuals and businesses to drive a higher-spec vehicle for the same budget they might allocate to a lower-tier purchased model. This financial flexibility can be a game-changer for budgeting.

Drive the Latest Models and Technology Frequently

Automotive technology evolves at a rapid pace, especially in the pickup truck segment with advancements in towing, fuel efficiency, safety, and infotainment. Leasing allows you to upgrade to a brand-new truck every few years, typically every two to four years, without the hassle of selling your old vehicle.

Pro tips from us: This is particularly appealing for those who love staying current with the newest features, design aesthetics, and performance enhancements. You’ll always have access to the latest innovations, ensuring your work or adventures are supported by cutting-edge engineering. This constant refresh keeps you ahead of the curve.

Benefit from Consistent Warranty Coverage

When you lease a new pickup truck, it comes with a full manufacturer’s warranty. Since most lease terms align with or are shorter than the typical bumper-to-bumper warranty period (e.g., 3 years/36,000 miles), you’re almost always covered for major repairs. This provides immense peace of mind.

Common mistakes to avoid are neglecting routine maintenance, but with a lease, unexpected, costly mechanical failures are usually handled by the warranty. This protection against unforeseen expenses significantly reduces the financial risk associated with vehicle ownership, making your budgeting more predictable.

Potential Tax Advantages for Businesses

For businesses, leasing a pickup truck can offer considerable tax benefits. The IRS often allows businesses to deduct lease payments as an operating expense, which can be more advantageous than the depreciation deductions available when purchasing. This can lead to significant tax savings.

It’s crucial to consult with a tax professional to understand the specific rules and how they apply to your business’s situation. Based on my experience working with various businesses, these deductions can make a commercial truck lease a very attractive financial strategy, especially for fleets or individual work vehicles.

Avoid the Hassle of Selling a Used Vehicle

Selling a used vehicle can be a time-consuming and often frustrating process, involving advertising, negotiating with potential buyers, and dealing with paperwork. With a pickup truck lease, you simply return the vehicle to the dealership at the end of the term. This eliminates all the complexities and stresses of the private sale market.

This convenience is a major draw for many lessees. You don’t have to worry about the vehicle’s resale value, market fluctuations, or finding the right buyer. It’s a clean break, allowing you to seamlessly transition into your next new vehicle.

Leasing vs. Buying a Pickup Truck: A Detailed Comparison

Deciding between leasing and buying is a fundamental choice that impacts your finances, flexibility, and long-term vehicle strategy. Both options have distinct characteristics that suit different needs and preferences. Let’s dissect the core differences to help you determine which path is right for your pickup truck acquisition.

Financial Implications: Upfront, Monthly, and Long-Term Costs

When you buy a pickup truck, you typically face a larger down payment and higher monthly loan payments because you’re financing the entire purchase price. While you eventually own an asset, the initial and ongoing costs are greater. Conversely, a lease pickup truck often requires a smaller (or no) down payment and lower monthly payments, as you’re only paying for the vehicle’s depreciation during your usage.

However, over the long term, buying can be cheaper if you keep the truck for many years after paying it off. Leasing means you’ll always have a car payment if you continuously lease new vehicles. Understanding your financial horizon is key here.

Ownership vs. Usage: What’s Your Priority?

Buying a pickup truck grants you full ownership. You can customize it as you wish, drive unlimited miles, and keep it for as long as you desire. There are no restrictions on modifications or mileage, offering complete freedom. This sense of ownership and control is highly valued by many.

Leasing, however, is about usage, not ownership. You drive a new truck for a set period and return it. This means you don’t build equity, and there are limitations on mileage and modifications. If you prioritize driving a new vehicle every few years without the long-term commitment of ownership, leasing excels.

Flexibility and Customization: How Much Freedom Do You Need?

With a purchased truck, the sky’s the limit for customization. Lift kits, aftermarket accessories, performance upgrades – they’re all fair game because you own the vehicle. You can tailor it precisely to your needs and tastes without consequence.

A pickup truck lease offers less flexibility in this regard. Significant modifications are generally prohibited, as they can impact the vehicle’s residual value. While minor, easily reversible accessories might be acceptable, anything permanent or that deviates from original specifications could result in hefty fees at lease end. Consider your desire for personalization carefully.

Long-Term Value and Equity Building

When you buy a truck, you build equity over time as you pay down the loan. Once the loan is paid off, the truck becomes a valuable asset that you can sell or trade in for future purchases. This asset accumulation is a significant benefit of ownership.

With a truck lease, you don’t build equity. You’re paying for the privilege of using the vehicle. At the end of the lease, you have no ownership stake unless you choose to buy it out at the predetermined residual value. This means you won’t have a trade-in value to put towards your next vehicle.

Understanding the Mechanics of a Pickup Truck Lease

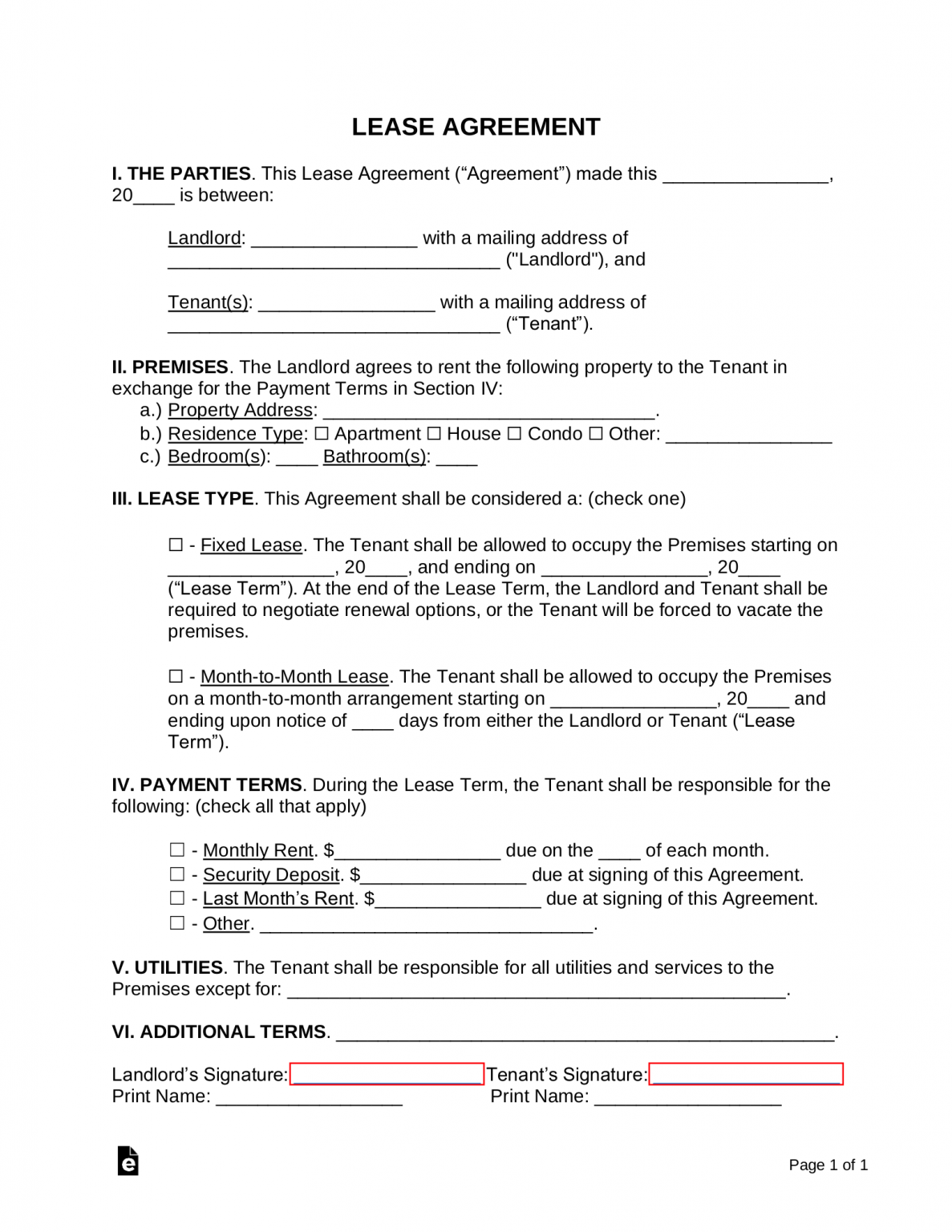

Before you sign on the dotted line for a lease pickup truck, it’s crucial to understand the key terms and how they influence your monthly payment. Demystifying this jargon will empower you to negotiate effectively and ensure you’re getting a fair deal.

Key Lease Terms Explained

Every lease contract is built upon a few core components. Grasping these will make you a more informed consumer.

Capitalized Cost

This is essentially the "selling price" of the vehicle in a lease agreement. It’s the starting point for your lease calculation. Pro tips from us: Always negotiate the capitalized cost as if you were buying the truck outright. A lower capitalized cost directly translates to lower monthly payments. Dealers often mark this up, so don’t be afraid to haggle.

It includes the MSRP, any additional features or accessories, and sometimes acquisition fees. Reducing this figure is your primary goal in lease negotiation.

Residual Value

The residual value is the estimated wholesale value of the pickup truck at the end of the lease term. It’s determined by the leasing company and is a crucial factor, as you are essentially paying for the difference between the capitalized cost and the residual value. A higher residual value means you pay for less depreciation, resulting in lower monthly payments.

Based on my experience, trucks, especially pickup trucks, tend to hold their value well, which can make them excellent vehicles to lease due to their often favorable residual values. This is why many find a pickup truck lease financially attractive.

Money Factor (Interest Rate)

The money factor is the lease equivalent of an interest rate. It represents the cost of borrowing the money for the lease. It’s typically expressed as a very small decimal (e.g., 0.00250). To convert it to an approximate annual interest rate, multiply it by 2400 (0.00250 x 2400 = 6%).

Common mistakes to avoid are not asking for the money factor directly. Dealers sometimes try to obscure this. Always ask for it and compare it to current interest rates to ensure it’s competitive. A lower money factor means lower monthly payments.

Lease Term

This refers to the duration of your lease agreement, typically expressed in months (e.g., 24, 36, 48 months). Shorter terms mean you upgrade more frequently but often come with slightly higher monthly payments because the depreciation is spread over fewer months. Longer terms can offer lower monthly payments but tie you to the vehicle for a longer period.

Your ideal lease term depends on how often you want a new vehicle and your budget. For a lease pickup truck, 36-month terms are very popular, striking a good balance between payment and upgrade frequency.

Mileage Allowance

Every lease contract includes a specified annual mileage limit (e.g., 10,000, 12,000, or 15,000 miles per year). Exceeding this limit results in excess mileage charges, which can range from $0.15 to $0.30 or more per mile. It’s crucial to accurately estimate your driving habits.

Based on my experience, underestimating your mileage is one of the most common and costly mistakes lessees make. Always err on the side of caution or consider purchasing additional miles upfront if you anticipate going over, as it’s often cheaper than paying penalties at the end.

The Calculation Process: How These Terms Combine

Your monthly lease payment is primarily calculated based on the difference between the capitalized cost and the residual value (the depreciation portion), plus the money factor applied to the sum of the capitalized cost and residual value (the finance charge). Taxes and fees are then added.

Understanding this formula allows you to identify which variables to focus on during negotiation. A lower capitalized cost and a lower money factor will always lead to a more affordable pickup truck lease.

Navigating the Lease Process: Step-by-Step for Your Pickup Truck

Securing a great deal on a lease pickup truck requires a strategic approach. It’s not just about walking into a dealership and picking a vehicle. Following these steps will put you in a strong negotiating position.

1. Researching Trucks & Deals

Start by identifying which pickup trucks meet your needs in terms of towing capacity, payload, features, and budget. Then, research current lease deals offered by different manufacturers and dealerships. Websites like Edmunds, Leasehackr, and manufacturer sites are excellent resources.

Look for special incentives, low money factor offers, or subsidized residual values that can significantly reduce your payments. This preliminary research is your foundation for a smart decision.

2. Setting Your Budget

Before you even step foot in a dealership, determine your absolute maximum monthly payment and how much you’re willing to put down (if anything). This firm budget will prevent you from being swayed by aggressive sales tactics.

Remember to factor in potential insurance costs, which can sometimes be higher for leased vehicles, and any maintenance costs not covered by warranty. A realistic budget keeps you in control.

3. Test Driving and Evaluating

Always test drive the specific models you’re considering. Pay attention to how the truck handles, its comfort, interior features, and how well it meets your practical needs. A lease pickup truck will be your companion for the next few years, so ensure it’s a good fit.

Don’t rush this step. Drive different trims and engine configurations if possible to get a comprehensive feel for your options.

4. Negotiating the Lease: Crucial Tips!

Negotiation is where you can save significant money. Pro tips from us: Focus your negotiation on the capitalized cost first, aiming for a price close to the invoice price or below. Then, inquire about the money factor and try to get it reduced if possible.

Don’t mention you’re leasing until you’ve negotiated the "purchase price" (capitalized cost). This prevents dealers from manipulating other lease terms. Also, inquire about any fees, such as acquisition fees or disposition fees, and see if they can be waived or reduced.

5. Understanding the Contract

Before signing, read every single line of the lease agreement. Common mistakes to avoid are rushing through the paperwork. Verify that all negotiated terms—capitalized cost, residual value, money factor, lease term, and mileage allowance—are accurately reflected in the contract.

Pay close attention to clauses regarding wear and tear, early termination penalties, and any additional fees. If anything is unclear, ask for clarification. Don’t sign until you fully understand everything.

Common Mistakes to Avoid When Leasing a Pickup Truck

While leasing offers numerous advantages, it also comes with potential pitfalls if you’re not careful. Based on my experience, being aware of these common mistakes can save you significant money and headaches at the end of your pickup truck lease.

Ignoring Mileage Limits

One of the most frequent and costly errors lessees make is underestimating their annual mileage needs. Exceeding your contracted mileage allowance can lead to hefty penalties, often between $0.15 and $0.30 per mile. This can quickly add up to thousands of dollars.

Pro tips from us: Be brutally honest about your driving habits. If you’re borderline, it’s almost always cheaper to opt for a higher mileage allowance upfront, even if it slightly increases your monthly payment, than to pay overage fees later.

Neglecting Wear and Tear

Lease agreements define "normal wear and tear." Anything beyond this, such as excessive dents, scratches, stained upholstery, or damaged tires, will incur charges when you return the truck. These "excessive wear and tear" charges can be surprisingly expensive.

Common mistakes to avoid are thinking minor damage won’t matter. Treat your lease pickup truck as if you own it, maintaining it meticulously. Consider getting a pre-inspection a few months before your lease ends to identify and address any potential issues beforehand, as it might be cheaper to fix them yourself.

Not Understanding End-of-Lease Options

Many lessees wait until the last minute to consider their options at the end of the lease. This reactive approach can lead to rushed decisions and missed opportunities. You typically have several choices: returning the truck, buying it, or leasing a new one.

Based on my experience, understanding these options well in advance allows for strategic planning. You can research new models, assess your truck’s market value versus its residual value, and prepare for the next step without pressure.

Failing to Negotiate Effectively

Some lessees treat a lease as a fixed price, but nearly every aspect of a lease is negotiable. Failing to negotiate the capitalized cost, money factor, or even certain fees means you’re leaving money on the table. This is a crucial aspect of securing a good pickup truck lease deal.

Always compare offers from multiple dealerships and be prepared to walk away if the terms aren’t favorable. Your power lies in your willingness to say no.

Focusing Only on Monthly Payments

While a low monthly payment is appealing, it shouldn’t be your sole focus. A low payment could be achieved through a high down payment, a longer lease term, or a high money factor that costs you more in the long run.

Pro tips from us: Look at the overall value proposition. Consider the total cost of the lease, including all fees, the capitalized cost, and the money factor, not just the attractive monthly figure. This holistic view ensures you’re getting a genuinely good deal.

End-of-Lease Options for Your Pickup Truck

As your pickup truck lease approaches its conclusion, you’ll be presented with several choices. Understanding each option in detail will help you make the best decision for your circumstances.

1. Returning the Truck

This is the most straightforward option. You simply return the vehicle to the dealership at the end of your lease term. Before doing so, ensure you’ve addressed any excessive wear and tear and are within your mileage limits to avoid additional charges. You’ll typically pay a disposition fee, which covers the dealer’s cost of preparing the vehicle for resale.

This option is ideal if you want to walk away cleanly and don’t want to deal with selling or owning the truck. It offers maximum flexibility to move into a new vehicle or change your transportation needs entirely.

2. Buying Out the Lease

If you’ve fallen in love with your lease pickup truck and want to keep it, you have the option to purchase it for the predetermined residual value stated in your lease contract. Sometimes, the market value of the truck might be higher than the residual value, making it a smart purchase.

Based on my experience, this is particularly appealing if you’ve stayed under your mileage allowance or if the truck is in excellent condition. You can finance the buyout or pay cash. This path offers you full ownership of a vehicle you already know and trust.

3. Leasing a New Truck

Many lessees choose to simply turn in their old pickup truck lease and lease a brand-new model. This allows them to continuously drive the latest vehicles with updated technology and safety features, and to always be under warranty. Dealerships often offer incentives for returning lessees.

This option is perfect for those who enjoy driving new cars frequently and want to avoid the long-term commitment of ownership. It’s a seamless transition into a fresh vehicle experience.

4. Extending the Lease

In some situations, you might be able to extend your current lease for a few extra months. This can be a good temporary solution if you need more time to decide on your next vehicle, or if you’re waiting for a specific new model to be released.

Common mistakes to avoid are assuming an extension is always possible or favorable. Always check the terms of the extension, including monthly payments and any updated mileage allowances, as they may differ from your original contract.

Who is Leasing a Pickup Truck Best Suited For?

A lease pickup truck isn’t for everyone, but for specific individuals and businesses, it’s an exceptionally smart choice. Understanding who benefits most can help you determine if it aligns with your lifestyle and financial goals.

Businesses and Entrepreneurs

For businesses that require reliable transportation and the utility of a pickup truck, leasing can be a powerful financial tool. It often comes with significant tax advantages, predictable monthly expenses, and allows for frequent upgrades to newer, more efficient models. This ensures a modern, professional image and access to the latest work capabilities.

Pro tips from us: A commercial truck lease frees up capital that can be invested back into the business, rather than tying it up in a depreciating asset. This liquidity is invaluable for growth and operational flexibility.

Individuals Who Love Driving New Vehicles

If you’re someone who enjoys the thrill of driving a new vehicle every few years, complete with the latest technology, safety features, and design, then a pickup truck lease is an excellent fit. It eliminates the depreciation hit of selling a used car and provides a fresh start every 2-4 years.

You get to experience a variety of models without the long-term commitment. This keeps your driving experience exciting and your vehicle modern.

Those with Predictable Mileage

Lessees who have a relatively consistent and predictable daily or annual mileage benefit greatly from leasing. If you consistently stay within the typical 10,000-15,000 miles per year, you won’t incur costly overage charges.

Based on my experience, people with regular commutes or specific work routes where mileage is known tend to be very happy lessees. It’s when mileage fluctuates wildly that leasing can become less ideal.

People Who Prioritize Lower Monthly Payments

For those who want to drive a higher-value vehicle but need to keep their monthly expenses in check, leasing is often the answer. The lower monthly payments allow access to premium pickup truck lease deals that might be out of reach if purchasing.

This financial strategy is particularly appealing to individuals who prefer to allocate their savings or income to other investments or expenses, while still enjoying a quality vehicle.

Pro Tips for Securing the Best Pickup Truck Lease Deal

Finding a great lease pickup truck deal goes beyond simply accepting the first offer. It requires strategy, timing, and informed negotiation. Here are some expert tips to help you maximize your savings.

Timing Your Lease

The end of the month, quarter, or year often brings the best deals. Dealerships are typically under pressure to meet sales quotas, making them more willing to negotiate favorable lease terms. Look for manufacturer incentives that often coincide with these periods.

Also, new model year introductions can lead to great deals on outgoing models. If you don’t need the absolute latest iteration, opting for a previous year’s model can result in a significantly cheaper truck lease.

Comparing Multiple Dealerships

Never settle for the first offer. Pro tips from us: Get quotes on the exact same pickup truck lease from at least three different dealerships, including those from different dealer groups. Use these quotes to leverage better deals against each other.

This competitive environment forces dealerships to offer their best prices to win your business. Don’t be afraid to email or call for quotes to save time.

Checking Manufacturer Incentives

Manufacturers frequently offer special lease programs with subsidized money factors, higher residual values, or cash incentives. These can dramatically reduce your monthly payments. Always check the manufacturer’s website before visiting a dealership.

These incentives are designed to move specific models and can turn a good lease into a fantastic one. Don’t assume the dealer will automatically offer them; sometimes you need to ask.

Knowing Your Credit Score

Your credit score plays a significant role in determining your money factor. A higher credit score (typically 700+) will qualify you for the best rates. Before you start the leasing process, obtain a copy of your credit report and score.

Based on my experience, addressing any inaccuracies or boosting your score can save you a substantial amount on interest over the lease term. A strong credit profile is your best friend in lease negotiations.

Considering a Shorter Term (Sometimes)

While longer lease terms often result in lower monthly payments, a shorter term (e.g., 24 months) can sometimes be more cost-effective if it aligns with special manufacturer incentives. It also means you’re out of the lease faster if your needs change or if you want to upgrade sooner.

Weigh the total cost of a shorter lease versus a longer one, considering all fees and the money factor. Sometimes, the sweet spot isn’t the longest term.

Conclusion: Is a Lease Pickup Truck Right for You?

Leasing a pickup truck offers a compelling alternative to traditional purchasing, providing access to newer models, lower monthly payments, and a hassle-free end-of-term experience. It’s a strategic choice for businesses, technology enthusiasts, and those with predictable driving habits who prioritize usage over long-term ownership.

By understanding the key lease terms, negotiating effectively, and avoiding common pitfalls, you can secure an excellent pickup truck lease deal that perfectly aligns with your financial goals and lifestyle. Remember, the goal is to make an informed decision that brings you value and satisfaction on the road.

Ready to explore your options? Start your research today, compare deals, and prepare to drive off in the perfect lease pickup truck that meets all your demands. Your next adventure or big project awaits!