Repossessed Pickup Trucks For Sale: Your Ultimate Guide to Unbeatable Deals and Smart Buying

Repossessed Pickup Trucks For Sale: Your Ultimate Guide to Unbeatable Deals and Smart Buying Typestruck.Guidemechanic.com

The allure of a powerful, versatile pickup truck is undeniable. Whether you need a reliable workhorse for the job site, a rugged companion for off-road adventures, or a spacious vehicle for family hauling, a pickup truck often represents freedom and capability. However, the price tag on a new truck can be a significant barrier for many. This is where the world of repossessed pickup trucks for sale steps in, offering a potentially golden opportunity to secure a fantastic vehicle without breaking the bank.

But what exactly are repossessed trucks, and is buying one a wise decision? This comprehensive guide will peel back the layers, providing you with an in-depth understanding of the repossessed vehicle market. We’ll explore the benefits, highlight the crucial risks, show you exactly where to find these deals, and arm you with a smart buyer’s playbook to navigate the process with confidence. Our goal is to empower you to make an informed decision, ensuring you drive away with a great deal and a truck that serves your needs for years to come.

Repossessed Pickup Trucks For Sale: Your Ultimate Guide to Unbeatable Deals and Smart Buying

Understanding Repossessed Pickup Trucks: What Are They Really?

Before diving into the deals, it’s essential to understand the origin of these vehicles. A repossessed pickup truck is simply a vehicle that a lender has taken back from its owner due to a failure to meet loan agreement terms, most commonly non-payment. This isn’t a reflection of the truck’s quality in most cases, but rather a financial circumstance of the previous owner.

When a borrower defaults on their auto loan, the bank, credit union, or finance company legally reclaims the vehicle to mitigate their financial loss. This process is known as repossession. Once repossessed, the lender’s primary goal is to sell the truck quickly to recover as much of the outstanding loan amount as possible. This urgency often translates into competitive pricing for potential buyers like you.

The journey from repossession to sale involves several steps. After the vehicle is recovered, it’s typically assessed, sometimes lightly cleaned, and then made available for sale. This can happen through direct sales channels, dedicated repo lots, or, most commonly, through auctions. Understanding this journey is the first step in appreciating the opportunities and nuances of this unique market.

The Allure of the Deal: Why Consider a Repossessed Pickup?

The primary magnet drawing buyers to repossessed pickup trucks is, without a doubt, the significant cost savings. These vehicles are priced to move, often considerably below their market value compared to similar used trucks found on traditional dealership lots. This difference can amount to thousands of dollars, making a quality pickup truck accessible to a wider range of budgets.

Lenders aren’t in the business of holding onto vehicles; their goal is to recoup funds quickly. This often means they’re willing to accept lower prices than a private seller or a conventional dealership might. For a savvy buyer, this translates directly into a more affordable pickup truck, allowing you to get a newer model or a higher trim level than you might otherwise afford.

Beyond the price, the variety available in the repossessed market can be surprising. You’ll find everything from basic work trucks and robust heavy-duty models to luxurious, fully loaded pickups. Many of these pre-owned repossessed vehicles are relatively new, sometimes only a few years old, and may have been well-maintained before the financial difficulties began. Based on my experience, many repossessed trucks offer an incredible balance of value and utility, presenting a real chance to own a high-quality vehicle without the premium price tag.

Navigating the Risks: What You Need to Know Before You Buy

While the potential for savings is high, buying repossessed pickup trucks isn’t without its challenges. It’s crucial to approach this market with a clear understanding of the risks involved. The most significant concern often revolves around the unknown history of the vehicle. Unlike a certified pre-owned truck from a dealership, detailed service records for a repossessed vehicle are frequently unavailable.

This lack of history means you might not know how well the previous owner maintained the truck, if it was involved in any unreported accidents, or if there are any underlying mechanical issues. The condition of these trucks can vary wildly, from nearly pristine examples to those showing significant wear and tear, or even minor damage from the repossession process itself. Common mistakes to avoid include assuming all repossessed trucks are in excellent condition or neglecting to perform due diligence because of an attractive price.

Another major consideration is the "as-is" nature of many repossessed sales, especially at auctions. This means there’s typically no warranty offered by the seller, and once you buy it, any repairs become your responsibility. Furthermore, at some repo truck auctions, opportunities for thorough test drives or detailed inspections can be limited, requiring buyers to be quick and decisive. Being aware of these potential pitfalls will help you prepare and mitigate them effectively.

Where to Find Repossessed Pickup Trucks For Sale: A Comprehensive List

Finding repossessed pickup trucks for sale requires knowing where to look beyond conventional dealerships. The market is diverse, with various channels offering these vehicles.

1. Bank and Credit Union Websites:

Many financial institutions maintain dedicated "repossessed vehicle" or "foreclosure vehicle" sections on their official websites. These are often direct sales, meaning you’re dealing directly with the lender. The inventory might be smaller and fluctuate, but the process can be more transparent than an auction. They typically list details, photos, and sometimes even offer financing options directly. Checking the websites of major national banks, as well as local credit unions, can yield some excellent finds.

2. Online Repo Car Auctions and Public Auto Auctions:

This is perhaps the largest and most dynamic market for repossessed vehicles. There are several types:

- Dedicated Repo Auctions: Some companies specialize solely in selling repossessed vehicles for various lenders. These platforms often have a constant flow of inventory.

- General Public Auto Auctions: Larger auction houses frequently have sections dedicated to repossessed inventory alongside trade-ins and fleet vehicles. These can be in-person or online. Websites like Copart or IAAI (though often geared towards salvage) or local public auction sites are good starting points.

- Government Auctions: Various government agencies, from the IRS and DEA to local police departments, periodically auction off seized or repossessed vehicles. These auctions can be unpredictable in terms of inventory but sometimes offer unique deals on used repossessed trucks. For a broader overview of federal government sales, you can check sites like USA.gov’s asset sales section which lists various types of government property for sale, including vehicles.

3. Dealerships Specializing in Repos and Wholesale:

Some independent used car dealerships specialize in buying repossessed vehicles at wholesale prices and then selling them to the public. These dealers often perform basic inspections and may even offer limited warranties or financing, making the buying process more akin to a traditional used car purchase. While their prices might be slightly higher than a direct auction, the added convenience and peace of mind can be worth it for some buyers.

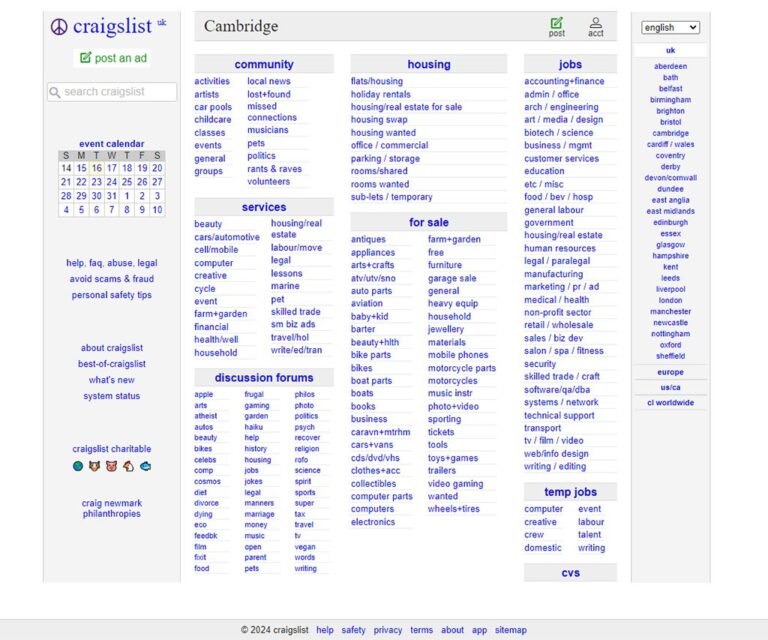

4. Online Marketplaces and Classifieds (with caution):

While not direct sources, platforms like AutoTrader, Cars.com, or even local classifieds can sometimes list repossessed vehicles. Often, these are listed by the dealerships that bought them from an auction, or occasionally by banks directly. When searching these sites, use keywords like "bank repo," "foreclosure truck," or "repossessed pickup" to filter your results. Always exercise extra caution and verify the seller’s legitimacy when using general online marketplaces.

The Smart Buyer’s Playbook: How to Buy a Repossessed Pickup Truck

Buying a repossessed pickup truck can be a rewarding experience if you follow a strategic approach. Here’s a detailed playbook to guide you through the process, minimizing risks and maximizing your chances of securing a great deal.

Step 1: Research, Research, Research

Before you even start looking at specific trucks, define your needs. What kind of pickup truck do you require? What models fit your budget and lifestyle? Research common issues for those specific models and their typical market value for different years and mileage. This foundational knowledge will help you identify a good deal when you see one and avoid problematic models. Knowing the fair market value for similar used pickup trucks will give you a strong bargaining position, especially if you’re buying from a direct seller.

Step 2: Set a Realistic Budget

Your budget should encompass more than just the purchase price. Factor in potential repair costs, especially since many repossessed trucks are sold "as-is." Don’t forget sales tax, registration fees, insurance, and any transportation costs if you’re buying from an out-of-state auction. Having a clear, comprehensive budget will prevent unexpected financial strain after the purchase. It’s often wise to set aside an additional 10-15% of the purchase price for immediate post-purchase maintenance or repairs.

Step 3: Thorough Vehicle Inspection – The Non-Negotiable Step

This is arguably the most critical step. Never buy a repossessed pickup truck without a professional pre-purchase inspection by a trusted, independent mechanic. Even if it costs a few hundred dollars, it could save you thousands in future repairs. Pro tips from us: Arrange for the inspection before you bid or commit to purchase.

What should the mechanic look for? They should meticulously examine the engine, transmission, brakes, suspension, tires, frame for any damage (especially rust), electrical system, and all major components. Even minor details like fluid leaks, warning lights on the dashboard, and unusual noises during a test drive (if permitted) can indicate significant underlying problems. A professional inspection offers peace of mind and leverage for negotiation if issues are found.

Step 4: Get a Vehicle History Report (VHR)

A Vehicle History Report from services like CarFax or AutoCheck is indispensable. This report can reveal crucial information such as accident history, previous ownership, odometer discrepancies, service records (if reported), and whether the vehicle has a salvage, flood, or lemon title. Even if the lender doesn’t provide one, investing in a VHR yourself is a small price to pay for vital information about the truck’s past. Be wary of any repossessed pickup that has a "salvage" title, as these often come with extensive, costly damage.

Step 5: Understand the Sale Terms

Whether you’re buying from an auction or directly from a bank, carefully read and understand all the terms and conditions of the sale. This includes payment methods, deadlines, fees (buyer’s premiums at auctions), and the exact condition of sale (e.g., "as-is"). Auction rules can be complex, so familiarize yourself with bidding increments, proxy bidding, and what happens if you win. Clarify if a title is readily available or if there will be a waiting period.

Step 6: Financing Considerations

Securing financing for repossessed trucks can sometimes be trickier than for traditional used vehicles, especially if they are sold "as-is" or through unconventional channels. It’s highly advisable to get pre-approved for a loan from your bank or credit union before you start seriously looking. This gives you a clear budget and allows you to act quickly when a good deal on a repossessed pickup truck arises. Some lenders might be hesitant to finance vehicles with unknown histories or those sold without a warranty.

Step 7: The Test Drive (If Possible)

If the opportunity for a test drive is available, take it! Pay close attention to how the truck handles, brakes, accelerates, and shifts gears. Listen for any unusual noises from the engine, transmission, or suspension. Check that all lights, wipers, air conditioning, and electronics are functioning correctly. A thorough test drive complements the mechanical inspection, providing real-world insight into the truck’s performance and comfort.

Pros and Cons of Buying a Repossessed Pickup Truck

To help you weigh your options, here’s a quick summary of the advantages and disadvantages:

Pros:

- Significant Cost Savings: The most compelling reason, often leading to prices well below market value.

- Wide Selection: Access to a diverse range of makes, models, and configurations.

- Potential for High Value: Many are relatively new and in good condition, offering great value for money.

- Direct from Lender: Sometimes you can deal directly with the bank, simplifying the process.

Cons:

- Unknown History: Limited or no access to service records can hide past issues.

- "As-Is" Condition: Most sales come without a warranty, meaning you assume all risks.

- Limited Inspection Opportunities: Especially at fast-paced auctions, a thorough inspection might be challenging.

- Potential for Minor Damage: Some trucks may have cosmetic flaws or minor mechanical issues from neglect or the repossession process itself.

Beyond the Purchase: Ownership and Maintenance Tips

Congratulations, you’ve successfully purchased a repossessed pickup truck! Your journey doesn’t end there. To ensure your new investment serves you well, proactive ownership and maintenance are key. As soon as you take possession, schedule a comprehensive service appointment. This initial check should include changing all fluids (engine oil, transmission fluid, brake fluid, coolant), replacing filters (oil, air, cabin), checking brakes, and rotating tires. This establishes a baseline for future maintenance, giving you peace of mind. For more detailed advice, you might find our guide on (internal link placeholder) incredibly helpful.

Regular maintenance according to the manufacturer’s schedule is crucial for any vehicle, but especially for a used one with an uncertain past. Keep meticulous records of all services performed. Lastly, ensure you have appropriate insurance coverage for your new pickup. Depending on its value and your loan terms, comprehensive and collision coverage might be mandatory.

Common Myths and Misconceptions About Repossessed Vehicles

Let’s debunk some common myths surrounding repossessed pickup trucks:

- Myth: All repossessed trucks are junk. Reality: While some might be in poor condition, many are perfectly good vehicles, often only a few years old, that were simply caught in a financial downturn.

- Myth: You can’t get financing for a repossessed truck. Reality: It can be more challenging than for new or certified pre-owned vehicles, but it’s certainly not impossible. Getting pre-approved from your own bank or credit union is your best bet.

- Myth: You’re guaranteed a steal every time. Reality: While deals are plentiful, it requires diligent research, inspection, and smart bidding (at auctions) to truly get a "steal." Without proper due diligence, you could end up overpaying for a truck with hidden issues.

Final Thoughts: Is a Repossessed Pickup Truck Right for You?

The market for repossessed pickup trucks for sale offers a unique blend of incredible opportunity and potential pitfalls. It’s a landscape ripe for significant savings, allowing you to acquire a capable truck that might otherwise be out of reach. However, success in this arena hinges entirely on your preparedness, diligence, and willingness to thoroughly investigate any potential purchase.

By understanding the nature of these vehicles, knowing where to search, and meticulously following our smart buyer’s playbook, you can confidently navigate this market. The key is to approach it with an informed perspective, balancing the excitement of a great deal with a healthy dose of caution and professional scrutiny. For a broader understanding of buying used vehicles in general, consider exploring our (internal link placeholder).

Ultimately, if you’re willing to put in the legwork, a repossessed pickup truck could be your ticket to owning a reliable and powerful vehicle at an unbeatable price. Start your research today, and you might just find the truck of your dreams waiting for a new owner.