Driving Your Dream: How to Get Semi Trucks For Sale No Credit – Your Ultimate Guide

Driving Your Dream: How to Get Semi Trucks For Sale No Credit – Your Ultimate Guide Typestruck.Guidemechanic.com

The open road calls, promising independence, lucrative opportunities, and the thrill of being your own boss. For many aspiring owner-operators, the dream of owning a semi-truck is vivid. However, a significant hurdle often stands in the way: a lack of established credit or a less-than-perfect credit history. Traditional lenders often shy away from applicants without a robust credit score, leaving many wondering if their dream is simply out of reach.

But what if we told you it’s not? While challenging, finding semi trucks for sale no credit is absolutely possible. This comprehensive guide will equip you with the knowledge, strategies, and insider tips you need to navigate the world of commercial truck acquisition, even if your credit file is thin or non-existent. We’ll dive deep into alternative financing options, crucial preparation steps, and how to safeguard your investment.

Driving Your Dream: How to Get Semi Trucks For Sale No Credit – Your Ultimate Guide

The Credit Conundrum: Why "No Credit" Matters in Trucking

Before exploring solutions, it’s essential to understand why credit is such a significant factor in financing a semi-truck. Lenders use your credit history as a primary indicator of your financial reliability and your likelihood of repaying a loan. A strong credit score demonstrates a proven track record of managing debt responsibly.

When you have "no credit," it means there’s little to no information for lenders to assess this risk. This isn’t the same as "bad credit," which indicates a history of missed payments or defaults. Both scenarios, however, present a challenge because lenders operate on risk assessment. Without data, they perceive higher risk.

Based on my experience in the commercial lending space, the absence of a credit profile makes you an unknown entity. This often leads to immediate rejection from conventional banks and finance companies that adhere to strict lending criteria. They prefer dealing with established borrowers, which is why exploring alternative avenues is paramount for those seeking semi trucks for sale no credit.

Unpacking Your Options: Real Pathways to Semi Trucks For Sale No Credit

Navigating the market for semi trucks for sale no credit requires creativity and an understanding of non-traditional financing models. Here are the most viable pathways to consider:

A. Lease-Purchase Programs: A Common Entry Point

Lease-purchase agreements are one of the most popular avenues for aspiring owner-operators without strong credit. These programs allow you to operate a semi-truck with the option to purchase it at the end of the lease term. It’s essentially a long-term rental with a buy-out clause.

How They Work: You make regular lease payments, and a portion of each payment might be credited towards the purchase price, or you might have a balloon payment due at the end. The truck typically remains titled in the leasing company’s name until you complete the purchase. This arrangement allows you to build equity and demonstrate payment history while working towards ownership.

Pros:

- Lower Upfront Costs: Often requires a smaller down payment or even no down payment compared to traditional financing.

- Access to Newer Equipment: Many programs offer relatively new or well-maintained used trucks.

- Potential for Credit Building: Successfully completing a lease-purchase can help establish a positive payment history.

Cons:

- Higher Overall Cost: Lease payments, especially with no credit, often include a premium, making the total cost of ownership higher than a direct purchase.

- Strict Terms: Contracts can be complex and may include mileage limits, maintenance clauses, and significant penalties for early termination.

- No Equity Until Purchase: You don’t own the truck until the final payment or buyout, meaning no equity build-up during the lease term.

Pro Tips from Us: Always negotiate the terms, especially the residual value (the purchase price at the end of the lease). Understand what maintenance responsibilities fall on you versus the leasing company. Some programs are "walkaway" leases, meaning you can return the truck without penalty at the end, while others are "TRAC" (Terminal Rental Adjustment Clause) leases or dollar buyout leases, which have different implications for ownership and risk.

Common Mistakes to Avoid: Not reading the fine print is a huge pitfall. Many aspiring owner-operators get caught off guard by unexpected maintenance costs or hidden fees that are clearly outlined in a lengthy contract. Ensure you understand all responsibilities, especially regarding repairs and insurance, before signing.

B. Rent-to-Own Agreements: Flexibility with a Path to Ownership

Similar to lease-purchase, rent-to-own agreements offer another flexible path to acquiring semi trucks for sale no credit. While the terms are often used interchangeably, rent-to-own programs typically focus more on immediate possession and a clearer path to eventual ownership, often with less stringent initial credit checks.

How They Work: You pay a weekly or monthly rental fee, and a portion of that fee usually goes towards the purchase price of the truck. The agreement typically specifies an end date by which you must purchase the truck, or you forfeit your accumulated rental credits. These agreements are often less formal than traditional leases, sometimes offered by smaller dealers or even private individuals.

Pros:

- Lower Barrier to Entry: Often more accessible for those with truly no credit history.

- Immediate Use: You can start earning income with the truck right away.

- Clear Path to Ownership: The intent is clearly for you to eventually own the vehicle.

Cons:

- Higher Weekly/Monthly Payments: To compensate for the higher risk, payments can be substantial.

- Limited Protections: Less regulation than traditional financing means you need to be extra vigilant about contract terms.

- Risk of Forfeiture: If you miss payments, you can lose the truck and all accumulated equity.

Pro Tips from Us: Always get the agreement in writing, no matter how informal the seller seems. Clarify what happens if you miss a payment, what constitutes a default, and how much of your payments actually go towards the purchase price. Ensure the truck is thoroughly inspected before committing.

C. Private Sellers: Unconventional but Possible

Finding a private seller willing to offer owner financing for semi trucks for sale no credit is less common but certainly not impossible. This route bypasses traditional lenders entirely, making it an attractive option for those with credit challenges.

How They Work: In this scenario, the seller acts as the bank, providing you with a loan for the truck. You make payments directly to them under a mutually agreed-upon contract. This often happens when a seller is eager to offload a truck and is willing to take on some risk, perhaps because they’ve had trouble selling it conventionally.

Pros:

- Bypass Credit Checks: The seller’s decision is based more on your individual circumstances and their trust in you, rather than a credit score.

- Negotiable Terms: You can often negotiate more flexible payment schedules and interest rates directly with the seller.

- Potentially Lower Costs: Without bank fees and overhead, the overall cost might be lower.

Cons:

- Hard to Find: Sellers willing to owner-finance are rare.

- Increased Risk: Less consumer protection than with a regulated financial institution.

- Legal Complexity: Requires a robust, legally binding contract to protect both parties.

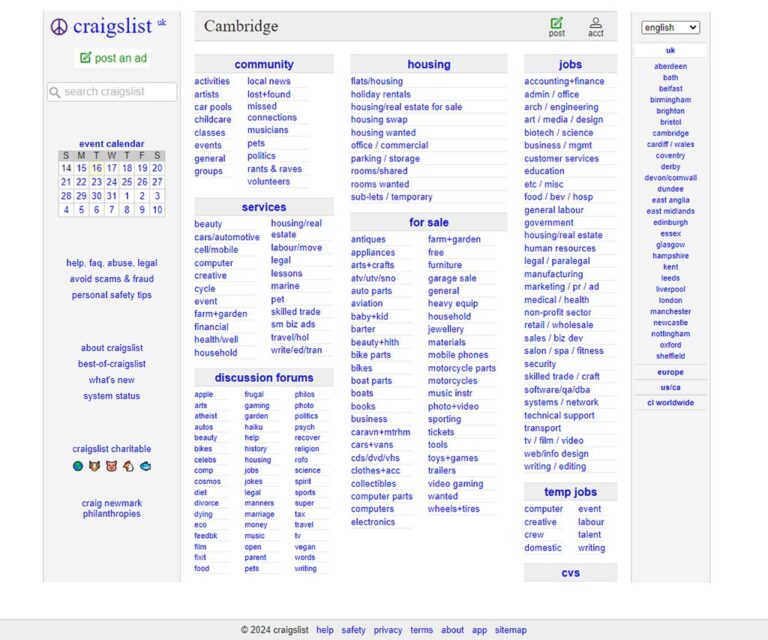

From my observations, this route requires more legwork and a strong ability to present yourself as a reliable and trustworthy individual. You’ll need to demonstrate your income and commitment convincingly. Search online classifieds, trucking forums, and local truck stops, and don’t be afraid to ask sellers if they’re open to financing. Always involve a legal professional to draft or review any owner-financing agreement.

D. Dealer-Financed Used Trucks: Specialized Programs

Some dealerships, particularly those specializing in used commercial trucks, have in-house financing divisions or partnerships with subprime lenders. These entities are more willing to work with buyers who have less-than-perfect credit or no credit history.

How They Work: These dealerships understand the market for owner-operators who may not qualify for prime loans. They often have programs tailored to assess your ability to pay based on income and down payment, rather than solely on your credit score.

Pros:

- Convenience: One-stop shop for truck and financing.

- Access to Inventory: These dealers often have a wide selection of used trucks.

- Experience with Bad/No Credit: They are set up to evaluate applicants beyond traditional credit metrics.

Cons:

- Higher Interest Rates: Due to the increased risk, interest rates will likely be significantly higher than conventional loans.

- Larger Down Payments: Expect to put down a substantial down payment to mitigate the dealer’s risk.

- Potentially Older Equipment: The available trucks might be older or have higher mileage.

Pro Tips from Us: Be prepared to explain any credit issues and demonstrate strong income. These lenders are looking for stability in your work history and a clear plan for generating revenue. Compare offers from several such dealerships, as terms can vary widely.

E. Co-Signers or Guarantors: Leveraging Trusted Relationships

If you have a trusted individual with good credit who is willing to co-sign for you, this can open doors to traditional financing options. A co-signer essentially guarantees the loan, promising to make payments if you default.

How They Work: The co-signer’s strong credit profile is used to bolster your application, making you a more attractive borrower to lenders. Their financial standing reassures the lender that the loan will be repaid, even if you, the primary borrower, face difficulties.

Pros:

- Access to Better Rates: With a co-signer, you might qualify for lower interest rates and more favorable terms than you would alone.

- Traditional Financing: Opens up options with conventional banks and credit unions.

- Credit Building Opportunity: Timely payments will help build your own credit history.

Cons:

- Risk for Co-Signer: The co-signer is equally responsible for the debt. If you default, their credit will be severely impacted, and they will be pursued for payment.

- Impact on Relationship: Financial agreements can strain personal relationships if issues arise.

Common Mistakes to Avoid: Not fully understanding the co-signer’s responsibilities or having an open, honest discussion about the risks involved. Both parties should be fully aware of the legal implications and potential consequences before entering such an agreement.

Preparing for Your Purchase: Boosting Your Chances

Even with semi trucks for sale no credit, thorough preparation can significantly improve your chances of approval and secure better terms.

A. The Power of a Down Payment

For those with no credit, a substantial down payment is often the single most important factor in securing financing. It reduces the lender’s risk by lowering the amount they need to finance.

Why It’s Crucial: A larger down payment demonstrates your commitment and financial capability. It tells the lender you have "skin in the game," making you a less risky proposition. It also reduces the principal amount, which can lower your monthly payments.

Saving Strategies: Start saving aggressively. Consider selling unused assets, taking on extra work, or even securing a small personal loan (if your credit allows) specifically for the down payment. Every dollar you can put down increases your leverage.

B. Demonstrating Income and Business Viability

Lenders want to see that you have a clear plan to generate sufficient income to cover your truck payments and operating expenses. Without a credit history, this proof of income becomes even more critical.

Proof of Consistent Work: Provide evidence of current and future work, such as signed contracts, letters of intent from brokers, or a history of successful engagements on load boards. Detail your experience as a driver.

Business Plan (Even Informal): Outline your business model, projected revenues, and estimated expenses. This shows you’ve thought through the financial realities of being an owner-operator. Even a simple spreadsheet can be effective.

Bank Statements: Provide several months of bank statements to show consistent cash flow and responsible money management, even if it’s not credit-related.

Pro Tips from Us: Show that you understand the total cost of running a semi-truck, not just the purchase price. Demonstrate awareness of fuel costs, insurance, maintenance, and other overheads. This builds confidence in your financial acumen.

C. Building a Strong Case (Even Without a Credit Score)

While you may not have a traditional credit score, you can still present evidence of responsible financial behavior.

Utility Bills and Rent Payments: Gather proof of consistent, on-time payments for utilities, rent, or other regular expenses. This indicates reliability.

Personal References: Obtain letters of recommendation from individuals who can vouch for your character and work ethic.

Business References: If you’ve worked for trucking companies, ask for references that highlight your professionalism and reliability.

D. Understanding the Total Cost of Ownership

Purchasing a semi-truck involves far more than just the sticker price. Many aspiring owner-operators underestimate the true cost, leading to financial strain.

Beyond the Truck Price: Factor in commercial truck insurance, ongoing maintenance (tires, oil changes, repairs), fuel costs, permits, tolls, and potential fees. These can quickly add up and impact your ability to make truck payments.

Budgeting is Key: Create a detailed budget that accounts for all these expenses. This will not only prepare you financially but also demonstrate your preparedness to potential lenders. For a deeper dive into budgeting for owner-operators, check out our article on .

Due Diligence: What to Look For and What to Avoid

When exploring semi trucks for sale no credit, due diligence is non-negotiable. The stakes are high, and protecting your investment is paramount.

A. Truck Inspection: Don’t Skip This!

Never buy a semi-truck without a thorough pre-purchase inspection (PPI). This is arguably the most critical step.

Independent Mechanic: Hire a qualified, independent heavy-duty mechanic to inspect the truck from top to bottom. They can identify hidden issues that could cost you thousands down the line.

Maintenance Records: Request all available maintenance and repair records. A well-documented history is a strong indicator of a truck that has been cared for.

Common Mistakes to Avoid: Buying sight unseen, relying solely on the seller’s word, or skipping a PPI to save a few hundred dollars. These "savings" often lead to catastrophic and expensive repairs shortly after purchase. Ignoring red flags, such as strange noises during a test drive or unaddressed dashboard warning lights, is another major error.

B. Understanding Contracts: Read Every Word

Whether it’s a lease-purchase, rent-to-own, or private seller financing, the contract is your roadmap.

Interest Rates, Fees, Penalties: Understand all financial terms. What is the actual annual percentage rate (APR)? Are there origination fees, late payment penalties, or early buyout fees?

Buy-Out Clauses: If it’s a lease or rent-to-own, clarify the buy-out price, when it can be exercised, and any conditions attached.

Legal Review: If possible, have an attorney specializing in commercial transactions review the contract before you sign. This small investment can save you significant trouble later.

C. Reputable Sellers/Lenders

Unfortunately, where there’s a demand for "no credit" options, there can also be predatory practices.

Research Reviews: Look for online reviews, testimonials, and industry reputation for any dealership or financing company you’re considering.

Ask for References: Don’t hesitate to ask for references from past customers, especially for smaller or private sellers.

Avoid High-Pressure Tactics: If a seller or lender is pressuring you to sign immediately or discouraging you from getting an inspection or legal review, walk away. A reputable entity will give you time to make an informed decision. For more information on reputable commercial truck dealers and financing companies, you can consult industry resources like the American Trucking Associations (ATA) or other reputable trade publications.

Beyond the First Truck: Building Your Credit for the Future

Securing your first semi-truck with no credit is a huge achievement, but it’s also an opportunity to build a stronger financial foundation for future endeavors.

A. Personal Credit Building

Even if you primarily operate as a business, your personal credit will always play a role.

Secured Credit Cards: These require a deposit but report to credit bureaus, helping you build a positive payment history.

Small Loans: If you can qualify for a small personal loan, timely repayment will boost your score.

Pay All Bills on Time: This includes utilities, rent, and any other obligations. Consistency is key.

B. Business Credit Building

Separating and building your business credit is crucial for long-term success as an owner-operator.

EIN and Separate Bank Account: Obtain an Employer Identification Number (EIN) from the IRS and open a dedicated business bank account.

Vendor Credit: Establish credit lines with suppliers (e.g., fuel cards, parts suppliers) that report to business credit bureaus.

Business Credit Cards: Once established, a business credit card can further build your business credit profile.

D&B Number: Register with Dun & Bradstreet to get a D-U-N-S number, which is widely used by lenders to assess business creditworthiness.

Learn more about establishing and improving your business credit in our guide to .

Conclusion: Your Road to Ownership Starts Now

The journey to acquiring semi trucks for sale no credit can feel daunting, but it is a path many successful owner-operators have traveled. It requires patience, meticulous preparation, and a willingness to explore alternative financing solutions. By understanding your options—from lease-purchase programs and rent-to-own agreements to private sellers and specialized dealer financing—you can find a pathway that suits your unique situation.

Remember, a substantial down payment, a clear demonstration of your ability to generate income, and unwavering due diligence on both the truck and the contract are your strongest allies. Don’t let a lack of credit define your trucking dreams. With the right strategy and commitment, the open road and the independence of owning your own semi-truck are well within your reach. Start preparing today, and drive towards your future.