Drive Your Dream: Unlocking Semi Trucks for Sale with No Down Payment (Your Ultimate Guide)

Drive Your Dream: Unlocking Semi Trucks for Sale with No Down Payment (Your Ultimate Guide) Typestruck.Guidemechanic.com

The open road calls to many, promising independence, significant earnings, and the thrill of being your own boss. For countless aspiring owner-operators, owning a semi truck is the first crucial step towards this dream. However, the hefty upfront cost, particularly the down payment, often feels like an insurmountable barrier. This is where the allure of "semi trucks for sale with no down payment" enters the picture.

Based on my extensive experience within the trucking and financial sectors, I understand the immense appeal and the complex realities behind these offers. This comprehensive guide will meticulously navigate the landscape of acquiring a semi truck without a traditional down payment, providing you with the in-depth knowledge and actionable strategies you need to make an informed decision and confidently hit the road.

Drive Your Dream: Unlocking Semi Trucks for Sale with No Down Payment (Your Ultimate Guide)

The Allure of "No Down Payment" Semi Trucks

The concept of driving away in your very own semi truck without shelling out thousands of dollars upfront is incredibly attractive. For many, it represents the only viable path to entering the owner-operator world or expanding their existing fleet. This option can significantly lower the initial barrier to entry for individuals with limited capital.

Imagine starting your trucking business journey with more of your savings available for operational costs, insurance, or unexpected repairs. This financial flexibility can be a game-changer, allowing new owner-operators to build a stronger financial cushion from day one. It empowers individuals who might otherwise be sidelined by the traditional financing requirements.

However, it’s crucial to approach these opportunities with a clear understanding of what "no down payment" truly entails. The trucking industry, like any other, has its nuances, and what appears to be a straightforward deal often comes with specific terms and conditions designed to mitigate risk for the lender. My professional advice is always to look beyond the headline and delve into the specifics.

Decoding "No Down Payment": What It Really Means

When you see "semi trucks for sale with no down payment," it rarely means absolutely zero financial commitment on your part. Instead, it typically signifies that the traditional cash down payment is waived, but other forms of security or higher financial qualifications are often required. Lenders need to protect their investment, and if you’re not putting money down, they will seek assurance elsewhere.

One common scenario involves a significantly higher interest rate on your loan. This increased rate compensates the lender for the higher risk associated with a no-down-payment deal. Over the life of the loan, these higher rates can translate into substantial additional costs, making the truck ultimately more expensive than if you had made a down payment. It’s a trade-off between immediate cash outflow and long-term expenditure.

Alternatively, "no down payment" might be structured as a lease-purchase agreement. In this model, you lease the truck for a set period with an option to buy it at the end of the term. While you might not pay a large sum upfront, you are essentially renting the truck, and a portion of your lease payments might or might not go towards the purchase price. Understanding the exact terms of such an agreement is paramount.

Who Qualifies for No Down Payment Semi Truck Deals?

Securing a semi truck with no down payment often requires demonstrating a strong financial profile or specific industry experience. Lenders are looking for reliability and a reduced risk of default. Meeting these criteria significantly improves your chances of approval and can even lead to more favorable overall terms.

A stellar credit score is often the golden ticket. Lenders use your credit history to assess your past financial behavior and predict your ability to repay future debts. A score in the excellent range (typically 700+) can open doors to more flexible financing options, including those with minimal or no down payment. It signals to the lender that you are a responsible borrower.

Beyond personal credit, your business history and experience in the trucking industry are critically important. If you’re an established owner-operator with a proven track record of successful hauling and consistent income, lenders will view you as a much safer bet. New owner-operators might need to provide a very robust business plan or have significant personal assets.

Even with less-than-perfect credit, options might exist. Some specialized lenders or dealer programs cater to individuals with lower credit scores, but these often come with stricter terms, higher interest rates, or requirements for additional collateral. It’s a balancing act where you trade a higher risk profile for the opportunity to get started.

Navigating the Market: Where to Find These Opportunities

Finding legitimate "no down payment" semi truck deals requires diligent research and knowing where to look. Not all dealerships or lenders offer these programs, and those that do often have specific criteria. Based on my observations, focusing your search on specialized avenues can yield better results.

1. Specialized Dealerships and Lenders: Many dealerships focus specifically on commercial trucks and understand the unique financing needs of owner-operators. These establishments often have relationships with a variety of lenders, some of whom specialize in programs requiring low or no down payment. They can often guide you through complex applications.

2. Manufacturer-Sponsored Programs: Major truck manufacturers occasionally offer special financing incentives to move inventory, which can sometimes include low or no down payment options for qualified buyers. These programs are often tied to specific truck models or new inventory, so keeping an eye on manufacturer promotions can be beneficial.

3. Owner-Operator Programs: Some trucking companies or fleet operators offer lease-purchase programs designed to bring new owner-operators into their network. While these aren’t direct "sales," they provide a path to ownership without a large upfront payment. They often come with dispatch services and a steady stream of freight, which can be a significant advantage.

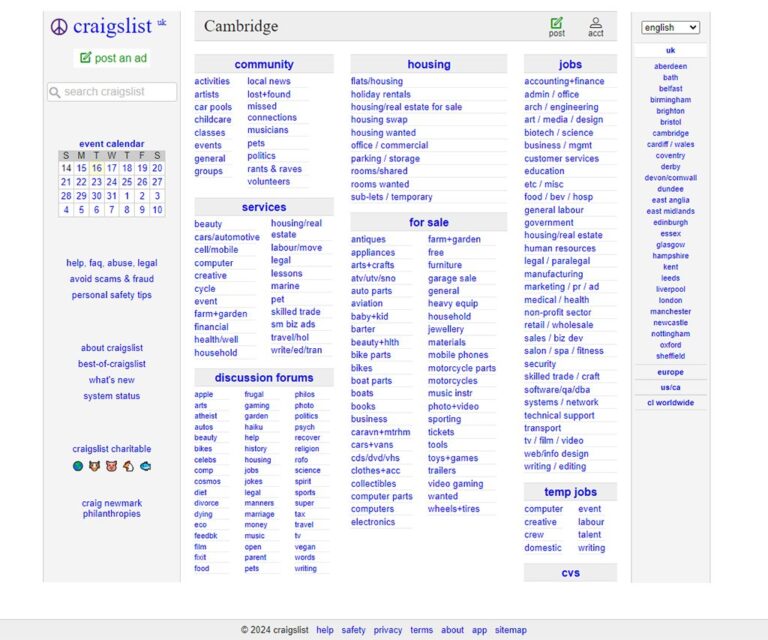

4. Online Marketplaces with Advanced Filters: Websites dedicated to commercial truck sales often allow you to filter by financing options, including "no money down" or "lease-to-own." While a good starting point, always verify the details directly with the seller or lender. can help you narrow down your truck preferences.

Understanding Your Financing Options

"No down payment" isn’t a single type of financing; it’s a feature that can be part of various financial structures. Understanding these distinct options is crucial for choosing the path that best aligns with your financial situation and business goals. Pro tips from us emphasize that the "best" option is the one that truly fits your long-term strategy.

1. Lease-Purchase Agreements: This is perhaps the most common route for no down payment semi trucks. You enter into a lease agreement with the option to purchase the truck at the end of the term.

- Pros: Low upfront cost, often includes maintenance programs, can be easier to qualify for.

- Cons: You don’t own the truck until the end, typically higher overall cost, strict terms, and often limited mileage or usage clauses. Failure to complete the purchase means you’ve essentially rented the truck without building equity.

- Expert Insight: Always clarify if lease payments contribute to the principal or if it’s a separate purchase option at the end.

2. Owner-Operator Programs: Some established trucking companies offer programs where they finance a truck for you, and you operate as an independent contractor under their authority.

- Pros: Often includes guaranteed freight, lower barrier to entry, structured support.

- Cons: Less independence, potentially lower per-mile rates, strict contract terms, and can be difficult to leave the program. You are tied to their specific operational model.

3. Government-Backed Loans (e.g., SBA Loans): The Small Business Administration (SBA) offers various loan programs that can be used for commercial truck financing, some of which may have low or no down payment requirements, especially for qualified small businesses.

- Pros: Lower interest rates, longer repayment terms, more flexible qualification for startups.

- Cons: Extensive application process, strict eligibility criteria, can take longer to secure funding. You’ll need a solid business plan.

- External Link: For more information on SBA loan programs, visit the official SBA website: .

4. In-House Dealership Financing: Some large dealerships have their own financing arms that can offer customized solutions, including no down payment options, especially for well-qualified buyers or specific inventory.

- Pros: Convenience, faster approval process, potential for negotiation on truck price and financing terms.

- Cons: May have higher interest rates than traditional banks, less flexibility, and limited to their specific inventory. Always compare their offer to external lenders.

The Critical Due Diligence Checklist Before Committing

Acquiring a semi truck, especially with no money down, is a massive financial commitment. Common mistakes to avoid include rushing into a deal without thoroughly vetting every aspect. Based on my experience, a comprehensive due diligence process is non-negotiable.

1. Thorough Truck Inspection (Pre-Purchase Inspection – PPI): Never, under any circumstances, buy a semi truck without an independent, professional mechanic inspecting it. This is even more crucial for no-down-payment deals, as these trucks might be older or have higher mileage.

- Focus Areas: Engine, transmission, brakes, tires, electrical system, frame integrity, and general wear and tear. A PPI can uncover hidden problems that could cost you thousands down the line.

2. Warranty Analysis: Understand exactly what warranties, if any, come with the truck. Is it a factory warranty, an extended warranty, or no warranty at all?

- Key Questions: What components are covered? What is the duration (miles/time)? What are the deductibles? Who performs the repairs? A good warranty can save you from unexpected major repair costs.

3. Insurance Requirements and Costs: Semi truck insurance is expensive, and you will need specific commercial coverage. Before committing to a truck, get quotes for primary liability, physical damage, cargo, and other necessary coverages.

- Budgeting: Factor these costs into your monthly expenses. Some no-down-payment programs might even require specific insurance types or minimum coverage levels.

4. Operational Budget and Business Plan: How will you make money with this truck? Develop a detailed business plan that outlines your target routes, freight types, projected income, and all operational expenses (fuel, maintenance, tolls, permits, repairs, taxes).

- Realism: Be realistic about your income potential and expenses. A solid business plan is not just for the lender; it’s your roadmap to success.

5. Reading the Fine Print: This cannot be stressed enough. Every clause in your lease or loan agreement must be understood. Pay close attention to interest rates, fees, penalties for late payments, early termination clauses, mileage limits, and maintenance responsibilities.

- Legal Advice: If possible, have an attorney specializing in commercial contracts review the agreement. This small investment can prevent major future headaches.

The Application Process: Step-by-Step Guide

Navigating the application process for a no down payment semi truck can seem daunting, but breaking it down into manageable steps makes it much clearer. Our professional advice is to be prepared and transparent throughout.

1. Gather Your Documents: This is the foundational step. You’ll need a comprehensive package of personal and business financial information.

- Personal: Driver’s license, Social Security card, proof of residency, personal tax returns (2-3 years), bank statements, credit report.

- Business (if applicable): EIN, business license, operating authority (MC number), business tax returns (2-3 years), profit and loss statements, balance sheets, bank statements, existing contracts or letters of intent for freight.

- Professional: CDL, driving record (MVR), trucking experience résumé.

2. Prepare Your Business Plan: As mentioned, this is crucial. A well-articulated plan demonstrates your understanding of the market and your commitment to success. Even if you’re a new owner-operator, a strong plan can compensate for a lack of history.

3. Research Lenders and Programs: Don’t just go with the first offer. Shop around and compare terms from different dealerships, specialized lenders, and manufacturer programs. Look for those with a reputation for working with owner-operators seeking no down payment options.

4. Pre-Qualification vs. Full Application: Many lenders offer a pre-qualification step, which gives you an idea of what you might qualify for without impacting your credit score significantly. Use this to narrow down your options before committing to a full application.

5. Interview and Negotiate: Don’t be afraid to ask questions and negotiate terms. Understand the total cost of the deal, not just the monthly payment. Discuss interest rates, fees, and any included services. Your goal is to secure the most favorable terms possible.

Common Mistakes to Avoid When Seeking No Down Payment Semi Trucks

Based on my professional observations, several pitfalls consistently trip up aspiring owner-operators. Avoiding these common mistakes can save you significant time, money, and stress.

1. Not Reading the Contract Thoroughly: This is the most critical mistake. Many issues arise from not understanding the full implications of a lease or loan agreement. Pay attention to every detail, especially hidden fees or clauses that restrict your operations.

2. Ignoring the Total Cost of Ownership (TCO): A no down payment deal might look cheap upfront, but high interest rates, mandatory insurance, maintenance costs, and other fees can make the TCO incredibly high. Always calculate the true long-term cost.

3. Underestimating Maintenance and Repair Costs: Semi trucks are complex machines, and breakdowns are inevitable. If your deal doesn’t include a comprehensive maintenance plan or warranty, ensure you have a robust emergency fund specifically for repairs. This is a common oversight.

4. Falling for Predatory Lenders: Be wary of deals that sound too good to be true, especially those promising "guaranteed approval" regardless of credit or history. Predatory lenders often charge exorbitant interest rates and fees, trapping borrowers in cycles of debt.

5. Lack of a Solid Business Plan: Without a clear strategy for generating income and managing expenses, even the best truck deal can lead to failure. Your business plan is your compass; don’t embark on this journey without one.

6. Impulse Buying: Never let the excitement of a "no down payment" offer push you into an immediate decision. Take your time, conduct your due diligence, and compare multiple options. A hasty decision can lead to buyer’s remorse and financial strain.

Building a Strong Financial Foundation for Your Trucking Future

Even if you secure a no down payment semi truck, actively working on your financial health is paramount for long-term success. This isn’t just about paying off your current truck; it’s about positioning yourself for future growth and stability.

1. Credit Building Strategies: Consistently make all payments on time, not just for your truck but for all your debts. Keep credit utilization low. Over time, a strong credit score will unlock better financing options, lower interest rates, and more favorable terms for future truck purchases or business expansion.

2. Saving for Emergencies: The trucking industry has its ups and downs. Having a dedicated emergency fund for unexpected repairs, periods of slow freight, or personal emergencies is crucial. Aim for at least 3-6 months of operating expenses in savings.

3. Investing in Professional Development: Stay updated on industry trends, new technologies, and regulations. Consider taking courses on business management, logistics, or advanced driving techniques. The more knowledgeable and skilled you are, the better positioned you’ll be for success.

Pro Tips from an Industry Veteran

From my years witnessing the evolution of the trucking industry and helping countless owner-operators achieve their dreams, here are some invaluable pro tips:

- Network Relentlessly: Connect with other successful owner-operators, industry mentors, and reliable brokers. Their insights and experiences can be invaluable, offering guidance that no textbook can provide.

- Embrace Technology: Utilize ELDs, GPS systems, and fleet management software to optimize your routes, track expenses, and improve efficiency. Technology is your ally in maximizing profitability.

- Prioritize Maintenance: A well-maintained truck is a reliable truck. Stick to a strict preventative maintenance schedule. It’s far cheaper to prevent a breakdown than to repair one on the side of the road.

- Understand Your Costs Per Mile: This is fundamental. Knowing exactly how much it costs you to operate your truck per mile allows you to bid on freight profitably and avoid losing money on runs.

- Patience and Persistence: The path to becoming a successful owner-operator is not always smooth. There will be challenges, but with patience, persistence, and a commitment to continuous learning, you can achieve your goals.

Conclusion: Your Road to Ownership Starts Here

Acquiring a semi truck for sale with no down payment is a tangible reality for many aspiring owner-operators. While it offers a compelling pathway to entrepreneurship, it requires careful consideration, thorough due diligence, and a clear understanding of the underlying financial commitments. It’s not a magic bullet, but a strategic financial tool that, when used wisely, can launch your trucking career.

By leveraging the insights and strategies detailed in this comprehensive guide, you are now equipped to navigate the market with confidence. Remember to prioritize thorough research, scrutinize all agreements, and build a robust business plan. The road ahead is challenging but immensely rewarding. With the right approach, you can indeed drive your dream truck and build a thriving trucking business, even starting with no money down. The open road awaits your journey!